Customer Loyalty vs Customer Retention: Is There a Difference?

Customer loyalty and retention often go hand in hand. But to provide better assistance to your clients, you need to understand the thin line between these two concepts. This is what we're talking around here.

Written by Olesia Melnichenko

Imagine that every customer who comes knocking at your door for the first time stays with you for long. Isn’t it lovely? Well, it all has to do with how you treat your client base. Even if your products or services are top-of-the-range and the pricing plans are flexible, it might not be enough to prevent customers from jumping ship. That’s when customer loyalty and retention enter the picture.

Your first assumption may be “hey, aren’t they the same?”. As a matter of fact, many brands take customer retention and loyalty as synonyms. Yes, they have similarities that can help you boost your marketing strategy. However, there’s still a thin line between these two aspects. You won’t be able to provide consistent customer service without marking the distinction properly.

Customer loyalty and retention definition

Customer loyalty shows how likely a client will keep doing business with a brand. This is the overall result of satisfaction not only with a product or service but also with every stage of their journey. That’s why it’s in your best interest to make it as smooth as possible and avoid offering poor customer service.

Speaking of customer retention, it’s the process of engaging existing clients to continue buying products or services from you. It’s directly impacted by how many new customers are acquired and how many of them churn – by canceling their subscription plan or having no wish to return.

Loyal clients spend 67% more when sticking with a business rather than new customers. How many partisans does your brand have? The chances are you’ve heard about the “80/20” rule (also known as the Pareto principle). If not, let me explain.

The rule is true in such areas as economics, software, and many others. But from the marketing point of view, the Pareto principle states that by identifying the characteristics of the top 20% of your customers (who represent 80% of your sales), you can find more clients like them and dramatically boost your sales. All in all, repeat customers tend to generate profits 16 times more efficiently than one-time customers.

One of the world-famous coffeehouses Starbucks has nailed loyalty by providing a winning program: My Starbucks Rewards. It actually pays off to be its member. You can get a free drink on your birthday, in-store coffee or tea refills, or a bakery item. Besides, this loyalty campaign allows you to skip the line and order personalized beverages before getting to the store.

As the research states, acquiring new clients is from 5 to 25 times more expensive than retaining new ones. If you decide on the second option, you have to go the extra mile and fine-tune everything from your budget to staff. But what if you concentrate on your current client base? The data in the same report shows that increasing customer retention rates by 5% can boost profits by 30% to 95%. The bottom line is retaining clients is cheaper and more profitable.

The impeccable example here is the Amazon Prime membership program that gives access not only to a faster delivery but also free music, ebooks, streaming video services, and other perks. There is a stickiness factor as you can buy almost anything with the added benefits covering almost everyone with unique desires of their own.

The difference between customer loyalty and retention

Except for the obvious lexical difference between customer loyalty and retention, there’s more to it. On the one hand, a retained customer can make a purchase from you again or just won’t. They may switch to another brand once the time comes. Such customers may be retained just by the fact they haven’t shopped anywhere else yet.

On the other hand, a loyal customer will buy from you again and again. Plus, they usually encourage others to do the same. Yes, this often brings about quality referrals and positive word of mouth. And no, customer loyalty and retention go beyond spending bunches of money. Loyal clients are more likely to vouch for your business and become your brand advocates.

To slice and dice these concepts, we’ve pictured the key differences. Check them out:

| Loyalty | Retention | |

| DEFINITION | A situation where a customer develops a long-term preference to a brand | The ability of a company to make customers stick over some period of time |

| CONCEPT | Building bridges with customers | Preventing customer churn |

| APPROACH | Proactive | Reactive |

| MEASUREMENT | Individual customers | Percentage of customers during some period |

One study found that satisfied customers are more than 5 times more likely to repurchase and 4 times more likely to refer a brand to their friends. Plus, they are 7 times more likely to forgive a business in case of some misunderstanding or mishaps. Well, even though it’s true, step up your efforts to make customers happy.

Customer retention and loyalty measurement

There are many ways to keep track of loyalty, though I would like to bring up the following:

- Customer Lifetime Value (CLV): how much money a client can generate for your business. It’s calculated by multiplying the average customer spend by the average customer lifespan. The higher the CLTV is, the longer the customer loyalty would be.

- Customer churn rate: hike in prices, bad client onboarding process, unmet customer expectations, and counting. These are the reasons why most clients go away. Divide the number of clients churned during a time period by the number of clients at the start of the period, and you’ll get your churn rate.

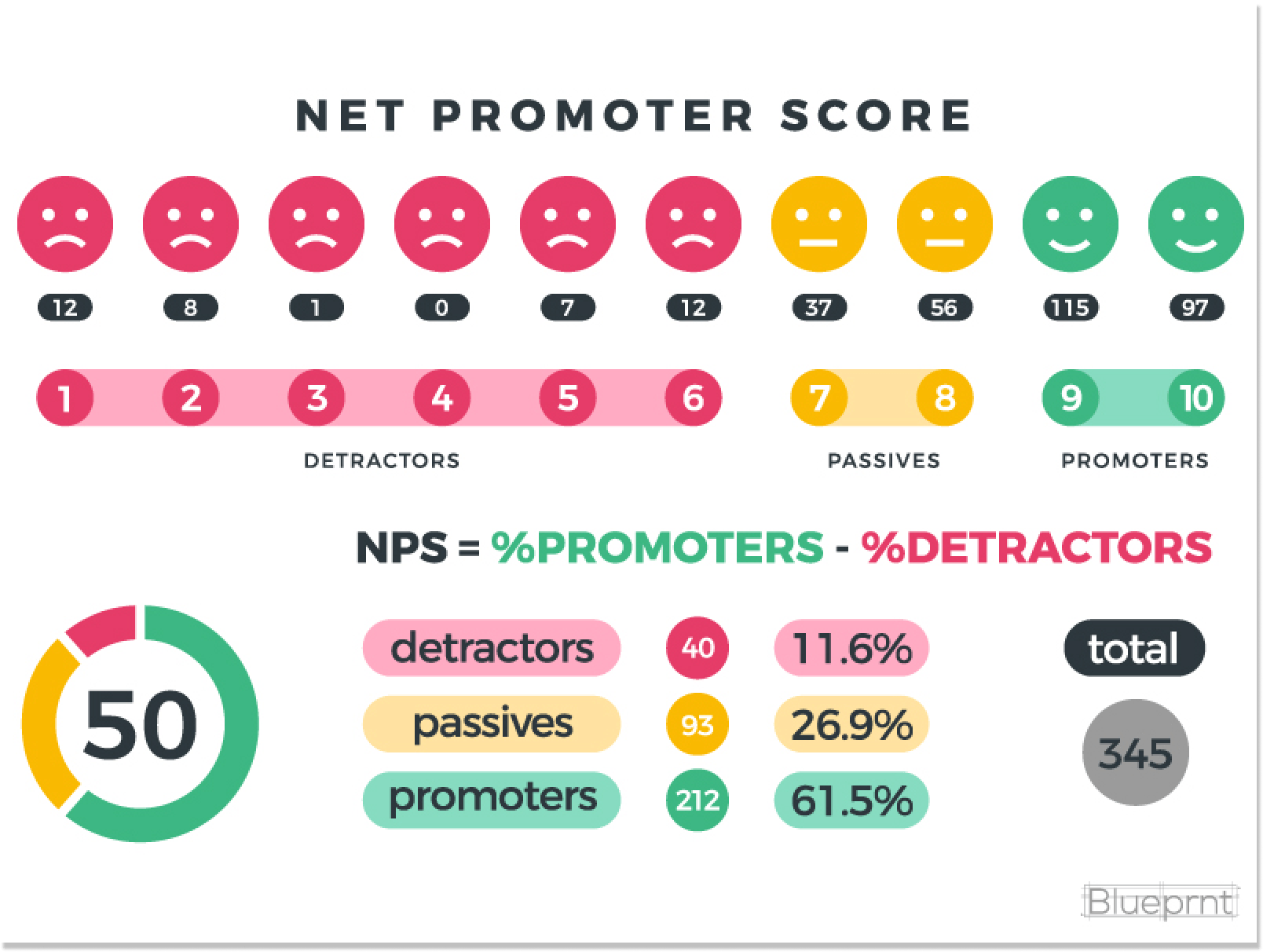

- Net Promoter Score (NPS): it indicates the willingness of your clients to spread the word about you to their friends. Detractors, Promoters, and Passives are the three categories of customers here. You’ll know the NPS by subtracting your Detractors percentage from your Promoters percentage.

To find out the retention rate, you need to deprive acquired customers during a time period from the number of customers at the end of a period, divide it by the number of clients at the beginning of the period and multiply it by 100.

Customer Retention Rate = ( (# Customers at End of Period – # Customers Acquired During Period) / # Customers at Start of Period) ) X 100

Imagine that your year starts with 20 customers, you gained 5 new clients in the first quarter, and 1 client churned: ( (24 – 5) / 20 ) ) x 100 = 95% retention

Final thoughts

Despite all the differences between customer loyalty and retention, I would say they are interrelated. Some companies may be still reactive in their approach for keeping clients retained, some of them may use various metrics to monitor the success, and some may aim at both building rapport with clients and preventing them from churn.

To have loyal and retained customers, you might need ultimate software at long last. Customer service, sales, marketing, pick what’s best for your business. Create a free account with HelpCrunch to ensure all your efforts are successful.